Rich Presidents of Poor Nations: Capital Flight from Resource-Rich Countries in Africa

by Léonce Ndikumana and James K. Boyce1

Read the PDF of this article here: pdf

Recently some African presidents have featured in media headlines not for their heroic accomplishments as leaders but for robbing their nations and siphoning their ill-gotten gains to safe havens. Since 2010, French judges have been investigating illicit wealth accumulation by the presidents of the Republic of Congo, Gabon, and Equatorial Guinea, all of whom are accused of embezzlement of public funds, money laundering, and plundering national wealth (Gurrey 2012).2 In July 2012, Judge Roger Le Loire issued an arrest warrant against Teodoro Ngema Obiang, nicknamed Teodorin, the son of the president of Equatorial Guinea, on the basis of evidence of illicit wealth accumulation through embezzlement of public resources. The stylish president’s son has amassed a portfolio that includes multi-million-dollar real estate in France, luxury cars, designer watches, and art objects. His personal financial transactions are handled through his forestry company, Somagui Forestal, and bank accounts in offshore centers.

Equatorial Guinea, Gabon, and the Republic of Congo are among the richest countries in Africa with per capita incomes of $8,649 (second), $4,176 (5th), and $1,253 (15th), respectively. They have massive oil reserves, ranking 7th (Gabon), 8th (Congo), and 10th (Equatorial Guinea) in the continent. While their presidents and other members of the political elite are amassing fortunes abroad, the majority of their fellow citizens live in abject poverty, lacking access to basic social services such as decent sanitation, clean drinking water, elementary school, and health care. Despite Equatorial Guinea’s large oil revenues, a baby born there has less chance of living to his or her fifth birthday than the average sub-Saharan African infant. Gabon and Equatorial Guinea rank second and third to last in their rate of immunization against measles, at 55% and 51%, respectively.

The stories of opulence and extravagant lifestyles of leaders of resource-rich African countries illustrate critical leadership failures, where national leaders rob their nations instead of helping to develop them. These pathologies are perpetuated by complicit foreign special interests and a shadow international financial system that enables the perpetrators of financial crime to walk free thanks to banking secrecy. They are also facilitated by the willful blindness of Western financial institutions and governments that have tolerated this illicit accumulation of wealth over the years.

This article tells a story of poverty in the midst of plenty, a story of elite capture of resources and expropriation of the people by those entrusted to advance national interests. It is a story of endemic grand corruption, well beyond mere bribe taking and opaque management of natural resources. It reflects systematic dysfunction of the judicial system and the regulatory framework, which have been hijacked by the political elite and powerful special economic interests.

The story features both domestic and foreign actors who collude in the capture of rents from natural resources and in the transfer of the proceeds to safe havens. This means that finding a solution to the problem requires looking beyond the natural resource sector and addressing dysfunctions in the entire economic and political system. It requires looking beyond the individual African countries and addressing the complicity of foreign parties, especially resource-exploitation companies that connive with corrupt leaders to embezzle wealth, banks that facilitate the illicit transfer of illicitly acquired funds, and regulators in advanced countries who turn a blind eye on illicit transactions involving African political and economic elites.

The oil bonanza

In the decades before the global financial crisis, resource-rich African countries enjoyed an explosion in their export revenue due to hikes in commodity prices, especially oil. Oil prices have resumed their ascent after the crisis. The oil boom has led to a rapid increase in oil rents collected by the governments of these countries. In 2010, the Republic of Congo collected over 61 percent of GDP in oil rents. In the same year, the oil rent/GDP ratio exceeded 40 percent in Equatorial Guinea (47%), Gabon (46%), Angola (46%) and Libya (42%). Between 2000 and 2010, oil rents more than doubled in many African oil producing countries (see Table 1). They tripled in Algeria, and went up fivefold in Angola and sixfold in Equatorial Guinea and Sudan.

Table 1: Oil rents and poverty in major African oil exporters

| Oil rents | GDP per capita in 2010 |

GDP per capita growth (constant 2000 $) |

Poverty | ||||||||

| % GDP 2010 |

Total amount, 2010 (million $) |

Absolute % change 2000-10 |

Absolute % change 2000-10 |

Compoundannual

% change 2000-10 |

Head count (% of population) | # ofpoor

(million) |

year | ||||

| National | Rural | Urban | |||||||||

| Algeria | 17.6 | 28510 | 202.7 | 4567 | 24.4 | 2.2 | n.a. | n.a. | n.a. | n.a. | n.a. |

| Angola | 46.1 | 38005 | 425.4 | 4322 | 108.9 | 7.6 | 55.9 | 62.3 | 10.7 | 2000 | |

| Cameroon | 7.1 | 1598 | 25.1 | 1147 | 11.1 | 1.1 | 39.9 | 55.0 | 12.2 | 7.9 | 2007 |

| Congo, DR | 3.9 | 512 | 98.6 | 199 | 21.6 | 2.0 | 71.3 | 75.7 | 61.5 | 54.6 | 2006 |

| Congo, Rep. | 61.6 | 7392 | 153.2 | 2970 | 22.1 | 2.0 | 50.1 | 57.7 | 2.6 | 2005 | |

| Côte d’Ivoire | 4.3 | 976 | 1114.4 | 1161 | -6.4 | -0.7 | 15.3 | 20.3 | 9.5 | 8.8 | 2008 |

| Egypt | 5.9 | 12859 | 80.4 | 2698 | 33.9 | 3.0 | 22.0 | 30.0 | 10.6 | 12.1 | 2008 |

| Eq. Guinea | 47.3 | 6852 | 586.5 | 20703 | 254.4 | 13.5 | n.a. | n.a. | n.a. | n.a. | n.a. |

| Gabon | 46.4 | 6122 | 100.9 | 8770 | 2.7 | 0.3 | 32.7 | 44.6 | 29.8 | 0.3 | 2005 |

| Libya* | 42.3 | 26675 | 86.2 | 9957 | 21.7 | 2.2 | n.a. | n.a. | n.a. | n.a. | n.a. |

| Nigeria | 29.5 | 57986 | 140.9 | 1242 | 45.3 | 3.8 | 67.9 | n.a. | n.a. | 130.5 | 2010 |

| Sudan | 18.5 | 12425 | 535.2 | 1538 | 44.9 | 3.8 | 46.5 | 57.6 | 26.5 | 18.7 | 2009 |

Source: World Bank, World Development Indicators; Poverty and Inequality Data.

Note: * For Libya, oil rents and real per capita data are not available for 2010; the data refer to 2000-2009.

As a result of the boom, oil-rich countries posted high economic growth rates over the past decade. Per capita GDP grew annually by 13.5% in Equatorial Guinea and by 7.6% in Angola. The oil bonanza vaulted these countries to middle-income status.3 Ghana has also recently joined the ranks of oil producers, and expected oil discoveries around the continent may further expand the club in the coming years.4 At least at face value, this is good news for Africa.

Underperformers in development: behind aggregate indicators

Indicators of aggregate economic performance in resource-rich African countries, however, say little about the conditions of ordinary citizens. Average national incomes are much higher in these countries than in many other African countries, but citizens with average incomes are few and far between. While some individuals are indeed extremely rich in these countries, lifting the arithmetic average, the majority of the people have received little from the resource bonanza. Their high poverty rates exceed the sub-Saharan average.5 In Nigeria, more than two-thirds of the population live below the national poverty line, meaning that they do not have enough income to meet basic daily needs (see Table 1). In the Democratic Republic of Congo, a country plagued by both institutional decay and civil strife, more than seven out of ten citizens are classified as poor.

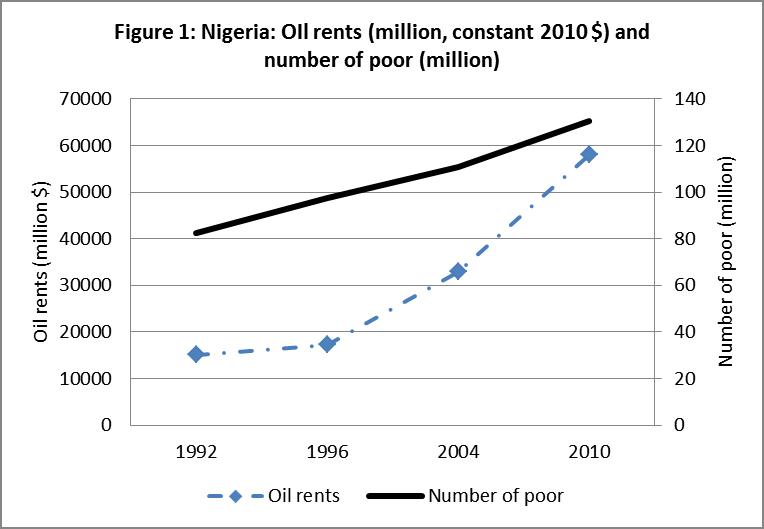

The oil boom has done little to ameliorate the living conditions of the poor. In Nigeria, the number of poor has risen even as oil rents were increasing (see Figure 1). From 1992 to 2010, the number of poor Nigerians (based on a daily-purchasing-power-adjusted income threshold of $2 per day) increased from 80 million to 130 million, even as oil rents nearly quadrupled from $15 billion to $58 billion (in constant 2010 dollars).

Along with high levels of poverty, resource-rich countries exhibit high levels of inequality. Poverty headcounts are much higher in rural areas than in urban areas, reflecting the preference for cities in public investments and allocation of infrastructure and services. In Cameroon, 55 percent of the rural population is poor compared to 12 percent of urban dwellers. In Sudan, the poverty rate in the countryside is more than twice that in urban areas.

Inequality in access to social services exacerbates the consequences of income inequality and further retards human development. In Gabon and the Republic of Congo, while 95% of the urban population have access to improved water sources, according to official figures, the majority of rural people lack access to clean drinking water (59% in Gabon and 68% in Congo).

An important reason for the inadequate provision of public services is substandard performance in public revenue mobilization. Oil-rich countries collect relatively less taxes than their resource-scarce counterparts (AfDB, OECD, and UNECA 2010; Ndikumana and Abderrahim 2010). It is remarkable that a resource-rich country like Nigeria collects less revenue in relation to its size (9% of GDP in 2008) than a resource-scarce country like Burundi (16.6% of GDP in 2008). The poor performance in tax mobilization is a result of, among other things, corruption in the oil industry, tax evasion, and capital flight.

Capital flight and elite capture of national resources

Natural resource-rich African countries suffered a severe financial hemorrhage through capital flight over the past decades. Recent estimates suggest that the leakages increased during the resource boom. From 1970 to 2008, Nigeria lost a staggering $296 billion to capital flight. About $71 billion went ‘missing’ from Angola between 1985 and 2008 (Ndikumana and Boyce 2011). Other oil-exporting countries also suffered substantial capital flight in the last four decades: Côte d’Ivoire ($45 billion), the DRC ($31 billion), Cameroon ($24 billion), the Republic of Congo ($24 billion), and Sudan ($18 billion).

A key source of capital flight is the natural resource sector. The two main mechanisms are outright embezzlement of export revenues by government officials entrusted with the management of public resource exploitation and commercialization, and the under-invoicing of oil exports. In 2002, for example, the IMF reported that as much as $4 billion of Angolan oil sale proceeds had not been accounted for over a period of four years (BBC 2002). This missing money finances private wealth accumulation by the political elite and their associates.

A critical issue in natural resource-rich countries is the lack of transparency in the management of resource revenue, and with it the lack of separation between politicians’ personal assets and public assets. The stories of stolen wealth by government officials repeatedly come back to the same fact: the plunder of public resources in the context of endemic corruption. In Nigeria, some state governors have taken advantage of their autonomy in the federal system to erect financial empires. Former governor James Ibori of Delta State became famous for embezzlement of state funds, money laundering, and bribery. His accomplishments included the diversion of $25 million from state coffers for the purchase of a jet for personal use. Joshua Dariye, Governor of Plateau State, and Diepreye Alamieyeseigha, Governor of Bayelsa State, similarly embezzled public funds and deposited them in bank accounts abroad. Swiss and Cameroonian authorities are still pursuing the assets of Yves Michel Fotso, the former director of Cameroon Airlines, including $31 million initially appropriated for the purchase of a government jet that subsequently disappeared. Apart from top political leaders and senior officials, their family members are often also involved in illicit financial flows, often using disguised identities, as in the case of Inge “Collins” Bongo, the first lady of Congo.6 The list goes on and on, and these are only the cases that are reported in the media. The plundering goes much deeper.

The plunder of national resources is not new in African autocracies. During his three-decade reign, Mobutu of Zaire (now the DRC) built what was referred as a “kleptocracy to end all kleptocracies” (Richburg 1991).7 It appears that he has had many studious disciples across the continent. Mobutu was able to ride on support from Western governments that regarded him as a strategic ally in the fight against communism during the cold war. But the cold war has ended, and African kleptocrats and their accomplices are still with us.

What can be done?

The culprits in African capital flight include not only corrupt leaders but many others who gain from illicit financial flows. These include natural resource exploitation companies, trading partners who facilitate misinvoicing, banks in safe havens, and middlemen and “deal makers” who facilitate transactions. Thus addressing the problem of capital flight and the plunder of natural resources requires a multipronged strategy, involving systemic changes aimed at establishing a culture of transparency in the management of national resources and ending the impunity traditionally enjoyed by politicians and their private associates.

African countries need to pursue strategies to encourage domestic investment and reduce the incentives of private wealth holders to smuggle their assets abroad. These economic measures will reduce the outflow of honestly acquired capital, but they will not address the endemic problems of corruption, embezzlement, and elite capture of national wealth described above, nor are they likely to entice the voluntary repatriation of stolen funds stashed in safe havens. We cannot expect the same politicians who robbed their countries to metamorphose into champions of good governance and accountability.

A key element of the solution to capital flight must therefore be the establishment and consolidation of democratic governance. To be sure, democracy is not a panacea: it can be hijacked by strong interest groups. But it offers a better framework for giving the African people a voice in the management of public resources. To support the democratic process and public oversight on management of the national economy, it is important to promote open and transparent budgeting processes, especially open disclosure of the sources and utilization of public funds including resource revenues, borrowed funds, and external aid.

It is considered best practice in the business sector to undertake thorough annual audits of companies’ finances and operations. A similar practice needs to be instituted in the management of public finance. In particular, public external debts should be subjected to independent audit to establish their legitimacy and their contribution to national development. On the basis of these audits, external loans that fail the legitimacy test could be classified as odious and unilaterally repudiated. African countries could learn valuable lessons from the case of Ecuador, which has successfully implemented a systematic debt audit. The country saw a drastic reduction in its debt burden due to unilateral repudiation of debts that were found to be odious.8 Promoting transparency and accountability would benefit not only African countries but also their donors and lenders, as external resources would be more likely to be used for genuine development purposes, increasing aid effectiveness and reducing the risk of default on debt.

An important element of the strategy against capital flight is a vibrant civil society, especially an independent media. A common feature of most cases of kleptocracy described above is the lack of a free press, which helps shield financial crimes from public scrutiny.

Reforms are also needed at the international level with respect to three key players: banks, multinational corporations (MNCs) engaged in natural resource exploitation and trade, and the host governments of these banks and MNCs. Banks in global financial centers must be obliged to assist in the detection and tracking of illicit financial flows. They must be required to disclose all suspicious bank transactions, especially those involving “politically exposed persons.”9 This cooperation by banks is critical for the sharing of information among governments, an essential tool in the fight against corruption and capital flight. Multinational corporations must be held accountable by anti-corruption laws, such as recent legislation in the United States and the United Kingdom that encompasses crimes committed abroad.10 Other foreign governments should follow suit to establish a clean and level playing field in the corporate sector. They should also assist African governments in enforcing these laws on the African soil.11

In the long run, a stable global financial system founded on transparency and accountability will benefit not only Africa but also the world as a whole.

_________________________________________

Léonce Ndikumana and James K. Boyce are co-authors of Africa’s Odious Debts: How Foreign Loans and Capital Flight Bled a Continent (2011) and teach economics at the University of Massachusetts, Amherst. Léonce Ndikumana is Director of the African Policy Program at PERI. James K. Boyce is Director of PERI’s Development, Peacebuilding and Environment Program.

Endnotes

- The authors are grateful to Theresa Owusu-Danso for excellent research assistance. [Back to Text ↩]

- In October 2011, the United States also sought to seize $70 million in assets from Teodoro Nguema Obiang (http://www.bbc.co.uk/news/world-africa-15464988). [Back to Text ↩]

- With the exception of the Democratic Republic of Congo, all the major oil exporting countries listed in Table 1 belong to the middle-income category. [Back to Text ↩]

- Uganda has recently discovered oil. Substantial reserves may have also been discovered in Kenya by Tulow Oil PLC, the same company that undertook the successful oil exploration in Uganda. [Back to Text ↩]

- Unless otherwise stated, the statistics cited in this section are from the World Bank online databases for World Development Indicators (http://data.worldbank.org/indicator) and Poverty and Inequality Data (http://povertydata.worldbank.org/poverty/home/). [Back to Text ↩]

- Cases cited in this paragraph are documented at http://star.worldbank.org/corruption-cases/. [Back to Text ↩]

- For a detailed study on capital flight from the Congo under Mobutu see also Ndikumana and Boyce (1998 [Back to Text ↩]

- See Boyce and Ndikumana in this issue. [Back to Text ↩]

- In 1996, the United States established the Suspicious Activity Report (SAR), a discretionary report filed to the Financial Crime Enforcement Network (FinCEN) every time a bank encounters an activity that it considers to be “suspicious.” The enforcement of the provision is hampered by the lack of a clear definition of what is ‘suspicious’ and the fact that it is discretionary. [Back to Text ↩]

- Key recent legislation includes the U.S. Foreign Corrupt Practices Act (FCPA) (http://www.justice.gov/criminal/fraud/fcpa/) and the UK Bribery Act (http://www.legislation.gov.uk/ukpga/2010/23/pdfs/ukpga_20100023_en.pdf). [Back to Text ↩]

- For further discussion of how international reforms can assist in the battle against illicit financial flows in extractive resource sectors, see LeBillon (2011). [Back to Text ↩]